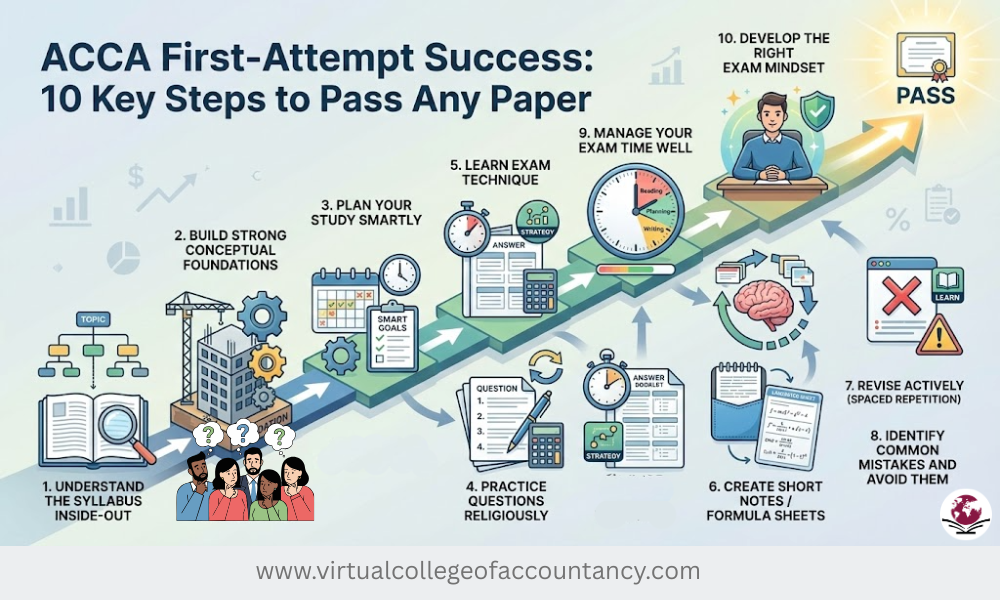

Key Steps to Pass Any ACCA Paper in First Attempt

Salam students! If you are reading this, we know exactly why you are here you want to pass your ACCA exams in the first attempt. And yes, it is completely possible!

ACCA may feel scary at first there are so many papers, so many topics, and it can seem overwhelming. But the truth is, with the right strategy, consistent practice, and smart mindset, you can clear every paper without repeating.

This guide is designed to help you understand the key steps you must follow to pass any ACCA paper, whether you are just starting at Applied Knowledge, moving to Applied Skills, or preparing for Strategic Professional papers.

Later, we will create detailed guides for each paper, so you can read step-by-step how to prepare for every paper and get maximum marks in your first attempt.

Think of this as your roadmap to ACCA success. Follow it carefully, and you will see a big difference in your preparation and confidence.

Step 1: Understand the Syllabus Inside-Out

Many students make the mistake of studying everything. This is a big waste of time and energy.

The first thing we must do is know the syllabus properly. Know exactly which topics are examinable and which are less important.

- Applied Knowledge Level: Focus on BT (Business & Technology), MA (Management Accounting), FA (Financial Accounting) basics, formulas, and concepts.

- Applied Skills Level: Focus on FFA, PM, TX, FR, LW, and practical things like financial calculations, reports, and ethics.

- Strategic Professional Level: Focus on SBL, SBR, and optional papers like AFM, APM, ATX, AAA here you need to understand real-life case studies, strategic thinking, and professional judgement.

Tip: Keep a printed or digital copy of your syllabus. Tick off topics as you finish them. This keeps your study organized and stress-free.

Don’t worry if it feels overwhelming we will soon release detailed guides for every paper, so you know exactly what to study and how.

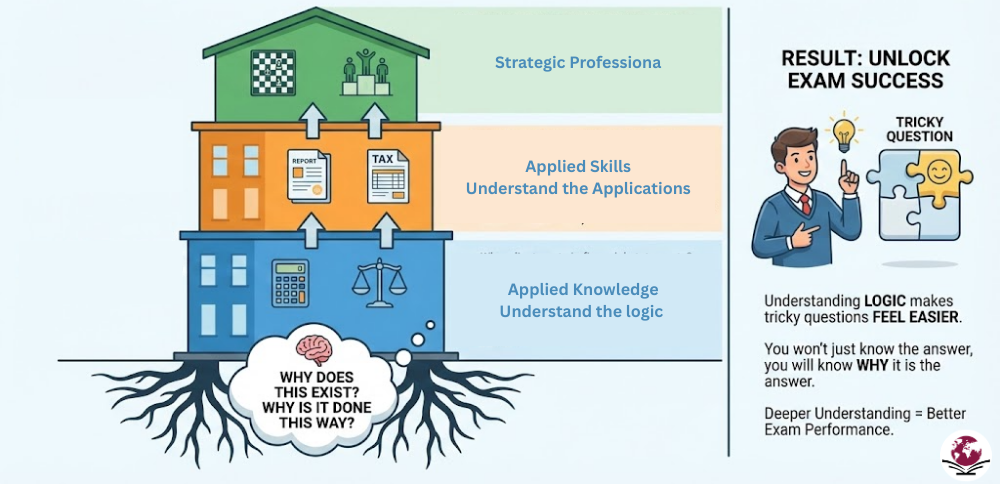

Step 2: Build Strong Conceptual Foundations

ACCA exams are not about memorizing definitions or formulas. They are about understanding concepts and why things happen.

Ask yourself: Why does this exist? Why is it done this way?

- Applied Knowledge: Why we make adjustments in financial statements, why costing methods differ, why ethics and corporate governance matter.

- Applied Skills: Why reports are prepared in a certain way, why taxation rules work like they do, why performance reports are structured the way they are.

- Strategic Professional: Why businesses make strategic decisions, how risk and leadership affect outcomes, why case study answers need proper reasoning.

When you understand the logic behind topics, tricky questions feel easier. You won’t just know the answer you will know why it is the answer, which helps a lot during exams.

And remember, our detailed paper guides will cover all topics step-by-step, making it much easier to understand these concepts.

Step 3: Plan Your Study Smartly

Many students fail not because they don’t know, but because they don’t plan their study. A proper study plan is the backbone of success.

- Make a weekly or monthly timetable

- Divide topics realistically per day

- Spend extra time on topics you find hard

- Include revision and short breaks don’t overload yourself

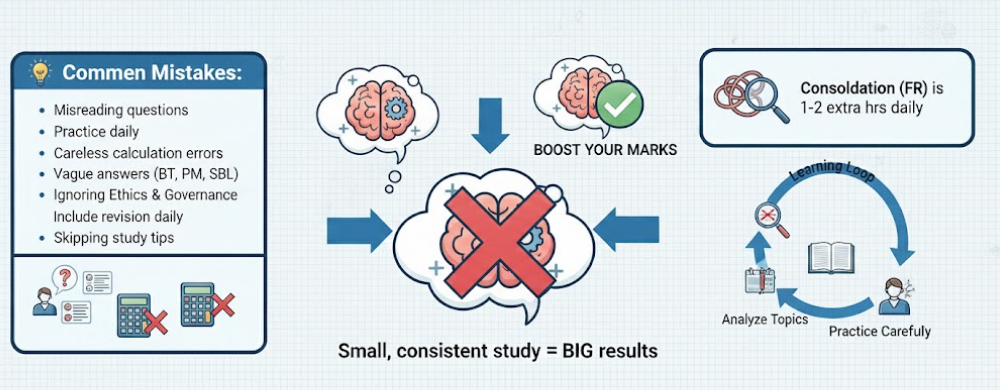

Example: If consolidation in FR is difficult, dedicate 1- 2 extra hours daily until you understand it. If MCQs in BT confuse you, practice them every day until you feel confident.

Tip: Small, consistent study sessions are much more effective than long, irregular hours.

In our upcoming guides, we will share level-specific study roadmaps, so you know exactly how to divide your time for every paper.

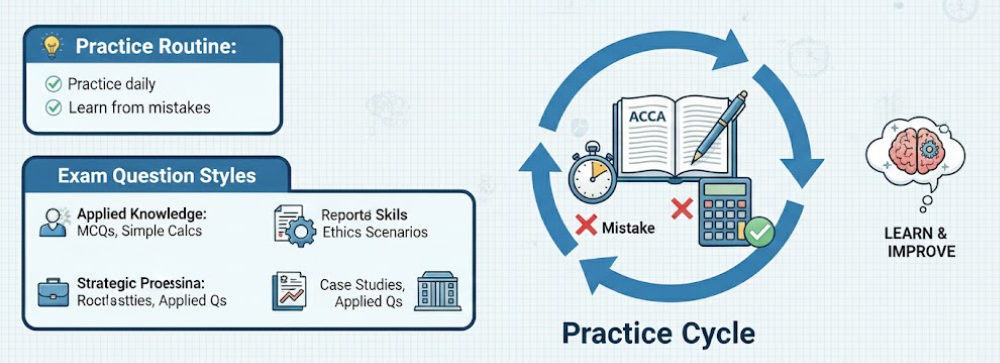

Step 4: Practice Questions Religiously

ACCA exams are pattern-based. This means if you practice well, you will feel confident and know what to expect.

- Applied Knowledge: mainly MCQs and simple calculations

- Applied Skills: calculations, reports, and ethics scenarios

- Strategic Professional: case studies, structured answers, and applied questions

Tip: Practice daily, redo questions, and learn from your mistakes. Mistakes are a part of learning the more you correct them, the stronger you get.

Don’t worry if you feel slow at first. In the detailed guides for each paper, we will share practice questions and examples, so you can see exactly what types of questions appear in exams.

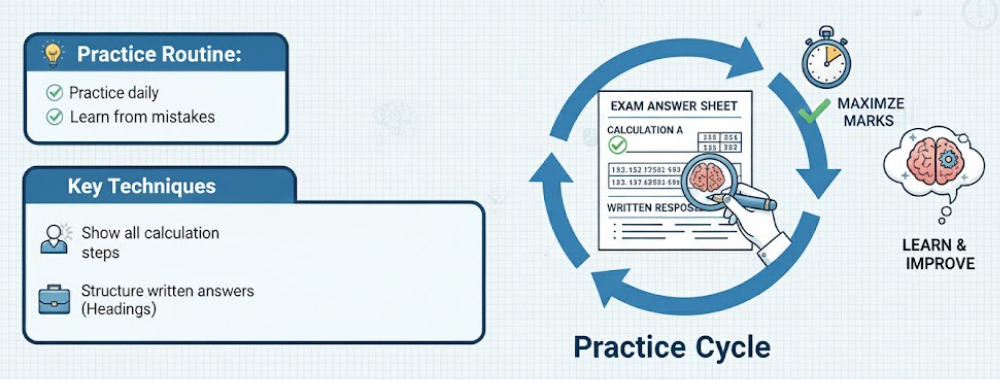

Step 5: Learn Exam Technique

Knowing the content is not enough. You need to answer the way examiners want.

- Show all steps clearly in calculations partial marks are often given

- Read questions carefully don’t assume or guess

- Structure written answers clearly, especially in FR, SBL, SBR, or case studies

Our upcoming guides will include exam tips for each paper, so you know exactly how to answer and score maximum marks.

Step 6: Create Short Notes / Formula Sheets

Short notes are your best friend before exams.

- Applied Knowledge: formulas, key definitions, ethics points

- Applied Skills: accounting principles, tax rules, reporting templates

- Strategic Professional: case study frameworks, strategic decision-making tools

Use sticky notes, small notebooks, or mobile notes. Review them daily, especially the week before exams. These notes save time and last-minute stress.

Step 7: Revise Actively (Spaced Repetition)

Reading once is never enough. Revision is key.

- Active recall: cover notes and explain without looking

- Spaced repetition: revise a topic today → tomorrow → after 3 days → weekly → before exam

This helps keep information in your long-term memory and avoids last-minute cramming.

Step 8: Identify Common Mistakes and Avoid Them

Many students lose marks due to simple mistakes:

- Misreading questions

- Careless calculation errors

- Vague answers in BT, PM, or SBL

- Ignoring ethics and governance

- Skipping tips in study materials

Avoiding these mistakes can boost your marks significantly.

Step 9: Manage Your Exam Time Well

Time management is critical at all levels.

- Allocate time for each question

- Attempt easy questions first, then harder ones

- Track total time so you finish comfortably

Proper time management reduces stress and ensures you answer all questions without panic.

Step 10: Develop the Right Exam Mindset

Your mindset is as important as knowledge.

- Stay calm panic kills marks

- Believe in your first-attempt success

- Take short breaks during preparation don’t burn yourself out

Consistency + Confidence = Success

Bonus Tip for All Levels

- Applied Knowledge: practice MCQs and calculations daily

- Applied Skills: practice calculations, reports, and ethics questions

- Strategic Professional: practice case studies, structured answers, and application questions

Daily practice ensures you are comfortable, confident, and fast during exams. Following these steps will dramatically increase your chances of passing ACCA exams on the first attempt, no matter which level you are at.

- Master the syllabus

- Build conceptual clarity

- Practice questions daily

- Learn exam techniques

- Stay organized, confident, and consistent

Remember, our detailed guides for every paper will show you exactly how to study, practice, and revise. Follow them step by step, and your ACCA journey will be much easier and stress-free.

ACCA Papers by Level – You Can Read Detailed Guides Soon

Applied Knowledge Level

Applied Skills Level

- FM: Financial Management

- PM: Performance Management

- TX: Taxation

- FR: Financial Reporting

- LW: Corporate and Business Law

Strategic Professional Level

Essentials:

9. SBL: Strategic Business Leader

10. SBR: Strategic Business Reporting

Options (choose 2):

11. AFM: Advanced Financial Management

12. APM: Advanced Performance Management

13. ATX: Advanced Taxation

14. AAA: Advanced Audit and Assurance

We will soon release detailed, step-by-step guides for each paper, so you can prepare efficiently and confidently for first-attempt success